🇲🇽❤️ 👩🏽¡Vengan a celebrar nuestro amor en MÉXICO! Vengan con su Mejor Energía. 👩🏽❤️👨🏼 Come celebrate our love in MEXICO! Bring your Best Energy. AMOR Y PAZ / PEACE AND LOVE 👱🏻♂️❤️🇲🇽

Adriana & Pachuco

🇲🇽❤️ 👩🏽¡Vengan a celebrar nuestro amor en MÉXICO! Vengan con su Mejor Energía. 👩🏽❤️👨🏼 Come celebrate our love in MEXICO! Bring your Best Energy. AMOR Y PAZ / PEACE AND LOVE 👱🏻♂️❤️🇲🇽

Adriana & Pachuco

ATMs & MONEY

🏧 ATMS / $$$ 💰

Should I get cash out of the Mexican ATM?

WHAT GOOGLE SAID ON THE SAME TOPIC!!!

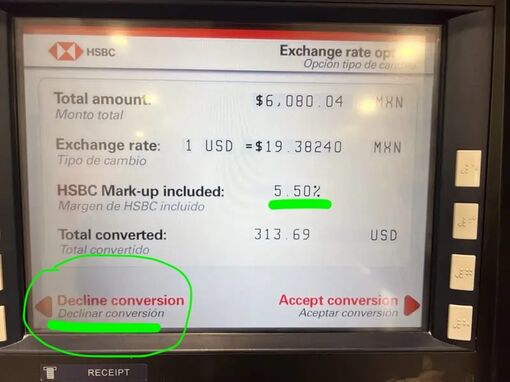

When withdrawing pesos from an ATM in Mexico using a foreign card, it's crucial to always choose to be charged in Mexican pesos (MXN) to avoid potentially higher exchange fees and unfavorable rates.

Here's a breakdown of key points:

Choose Local Currency:

When prompted by the ATM, select "pesos" or "withdraw in local currency" rather than "US dollars" or your home currency, as the ATM's conversion rate may be less favorable than your bank's.

ATM Fees:

Expect to pay a fee for using the ATM, which can vary between banks, but is typically between $20 to $109 MXN (around $1.00 to $5.00 USD) per withdrawal.

Bank Fees:

Be aware that your home bank may also charge a foreign transaction fee or international ATM fee in addition to the ATM fee.

Exchange Rate:

The base exchange rate for ATM withdrawals is typically set by card networks like Visa and Mastercard, not by individual banks.

Avoid ATM Conversion:

Do not accept the ATM's offer to convert the withdrawal to your home currency, as the rate offered may be significantly worse than your bank's rate.

Credit Card Cash Advances:

Cash withdrawals using credit cards typically have higher fees and interest charges than withdrawals from savings or checking accounts.

ATM Limits:

The ATM withdrawal limit in Mexico is around $4,000 to $11,000 MXN per transaction, but also depends on your own bank's card limits.