Should You Get a Prenup? We Vote Yes

While wedding planning, you may ask yourself: Should I get a prenup? No couple enters marriage believing that their love story will someday end. Statistically, however, one in three will walk down the aisle—and eventually into a courthouse to file their dissolution of marriage. Yet only 5 percent of to-be-weds sign a prenuptial agreement.

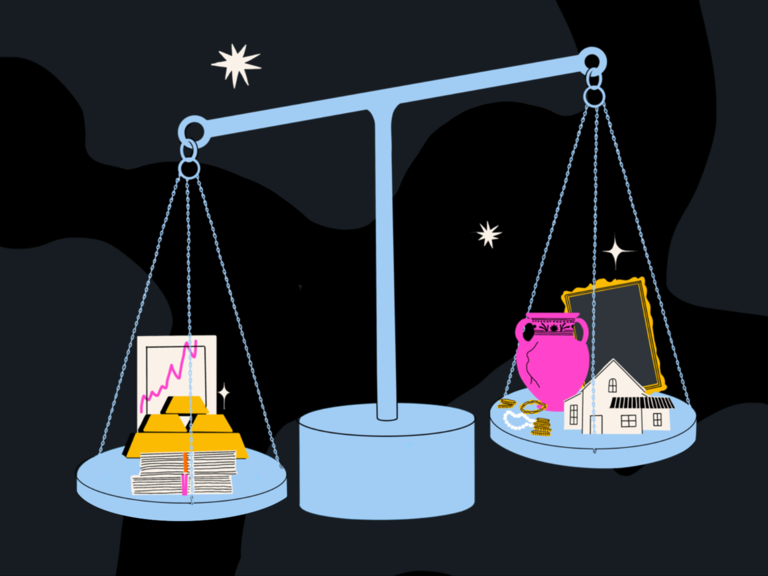

A prenup offers protection for both parties if you go your separate ways. Since it's legally binding within the state of registration, a marital agreement can influence the division of property and debt, or who gets child custody. "The interesting thing about prenups is you expect your partner to be a gold digger, you're a gold digger yourself, or you don't think this marriage is going to last," speculates Tori Dunlap, creator of HerFirst100K.com and author of Financial Feminist. "The truth is that most couples have a prenup already. It is chosen for you by the state. You already have a hard-and-fast legal order of operations of what happens if you separate." If you're wondering how to get a prenup or whether the decision is worth exploring, we explain more below.

In This Article:

- What Does a Prenup Do?

- How to Discuss Getting a Prenup with Your Partner

- Prenup vs Postnup: What's the Difference?

- We Want a Prenup. What Now?

What Does a Prenup Do?

"The act of discussing and negotiating a prenup gives engaged couples a platform with which to open up in-depth communication about important topics they may not have touched on before," says family lawyer Julia Rodgers, CEO of HelloPrenup. "Many couples find that through the process of negotiating a prenup, they learn about one another's needs, boundaries, and life goals. This structured inquiry into planning the future of their relationship leads both partners to a deeper understanding of one another."

Our data found that 46 percent of couples describe prenups as "smart," while another 20 percent perceived these contracts to be "cynical." Seventeen percent went so far as to call them "pointless." Prenups have built quite a reputation in pop culture, but we can learn something from the Real Housewives and the Kardashians. While each marriage differs, a solid prenup unifies couples in at least one respect: It encourages communication as you prepare for marriage. If you're still on the fence about whether to get one, here are 12 scenarios where a prenup may benefit you.

One of you is wealthier or has assets that are expected to appreciate.

You may want to protect your assets if you come into the marriage with a higher financial worth than your spouse. Rodgers, who founded her online prenuptial agreement service, gives an example of an engaged couple where one party purchased a home and the other party paid rent on it. If the couple divorced, some states might rule that the property should be split between owners.

You may want to protect your assets if you come into the marriage with a higher financial worth than your spouse. An example, says Rodgers, is seen through an engaged couple in their early 30s. "Lisa purchased a condo a year before she met John. Since she and John have been dating, he moved in and now pays 'rent' to Lisa. Lisa wants to make sure that even after they are married, her condo remains hers, and hers alone. She wants to protect both her initial investment of the down payment, as well as any appreciation that may accrue on the condo during their marriage, even while John is living there," she explains. "In their prenup, Lisa can list the condo as her separate property, and specify that any appreciation on the condo, as well as her initial investment, should remain hers and hers alone. If the condo gets sold in the future, the proceeds will be Lisa's separate property. If the proceeds from the sale get rolled into a joint marital home that Lisa and John buy together, her prenup can specify that the funds from the sale of her condo should remain her separate property, and not become marital (or community) property. Why does this matter? Depending on what state the couple lives in and the length of the marriage, the condo that Lisa bought could become marital property and subject to division in a divorce. A prenup allows the couple to prevent this scenario."

One or both of you has received sizable gifts.

Let's say your parents regularly give you money. Even after marriage, they may continue their generosity, but both parties won't necessarily agree on how to use the funds. "Without a prenuptial agreement, in most states, monetary gifts received during the marriage will be considered marital property," explains Rodgers. "A prenup allows couples to decide if they would like those monetary gifts to be considered separate property."

One or both of you will receive an inheritance.

The division of inheritance is a common issue couples will face in marriage. In some states, like Arizona and California, debts and assets (including an inheritance) are divided equally among spouses. Here's an example: "Lisa's parents plan to pass down a significant inheritance to her in the future. Lisa's parents are excited to welcome John into their family, but ask Lisa and John to consider a prenuptial agreement to protect any inheritance they pass down to her in the future," says Rodgers. "Lisa and John agree that any inheritance from either of their parents should be considered the property of the spouse from whose family the inheritance came from. This arrangement of categorizing inheritance as separate property can be contracted to in a prenuptial agreement. This is becoming more common as an unprecedented generational wealth transfer is beginning to occur between baby boomers and their millennial children."

"Without a prenuptial agreement, inheritance may or may not be considered marital property," notes Rodgers. "Many parents who are considering passing down their wealth to their children, either in trusts or other instruments, [are typically] concerned about the prospect of their hard-earned wealth being split during a divorce."

At least one of you has been married before.

Some circumstances may be different than they were in the first marriage. If you're bringing assets or monetary commitments into a new marriage (such as child support and multiple properties), you may want to keep them separate from your new spouse's financial responsibilities.

At least one of you has children.

Let's say one party has kids from a previous marriage. A prenup can help you establish what part of the estate would go to the spouse's children. It also ensures family members have a financial plan in the case of death. Wills are still necessary, but prenups can establish intent from both parties.

One of you has significantly more debt.

If your partner is repaying hefty student loans or acquires extreme credit card debt during your marriage, you probably don't want to take on that burden after a split. "In a divorce, judges in many states have immense discretion as to how debt should be distributed among the parties," says Rodgers. "In certain situations, a judge could choose to attribute some of one spouse's debt to the other, especially

in the case where the other party directly benefited from the result of that [loan or purchase]."

You plan to buy property together.

When purchasing a property together, experts still recommend that you keep your initial investments separate. Say a couple plans to buy a condo together, but one party has saved much more for a down payment. "In a divorce, the money that one party contributed to the down payment, although not equal, would likely be considered as 'transmuted' or absorbed into the marital estate and split upon sale of the property," says Rodgers. A prenup can protect those initial investment amounts.

One or both of you are small business owners or entrepreneurs.

Protecting your investments can be important if you own a closely held family business, a business with your name on it or a business with other people. Imagine that one partner is more relaxed with budgeting and also owns a business. Though the rewards are great, there are risks too.

"Without a prenuptial agreement, the conservative spouse may be responsible for some of their partner's business debt and entitled to some of the business," explains Rodgers. "The most extreme and complex divorce cases arise when one spouse is a business owner, and the judge deems the other spouse entitled to some of that equity." In short, it could get very expensive when litigating a divorce.

You want your privacy in the event that your marriage ends.

Nobody wants their personal matters to be leaked to the public, and a prenup can ensure that that won't happen. Confidentiality clauses are becoming standard in many prenups. They make sure that neither party could disparage the other on social media, television, in any publication (including a memoir) or publicize negative aspects of their marriage or financial lives.

You were engaged for a very short period of time.

Some couples meet and get married quickly, so a prenup is smart if you don't know each other that well. Other couples don't want to talk about it while wedding planning and sign a postnuptial agreement after the marriage is legalized. (By the way, you can get a postnup anytime after you marry.)

One of you doesn't work or doesn't plan to work.

If one party will be staying at home to raise a child, for example, the couple can work through an agreement to recognize that individual's unpaid labor. By agreeing on financial provisions, both parties will have a plan in the event of a divorce.

You believe you choose your destiny.

A prenup provides a sense of peace for couples who simply want to be prepared. "One of the beautiful things about getting a prenup or a postnup is that you and your partner get to decide what happens should you separate, as opposed to the state," says Dunlap. Finally, discussing your respective assets and liabilities also promotes communication, a pillar in any healthy relationship. With contractual services available online, there's little reason not to discuss your financial situation with your partner. Trust us: Sign the prenup before the marriage license.

How to Discuss Getting a Prenup with Your Partner

It isn't the easiest conversation to broach with your future spouse, but it's a valued and necessary topic to discuss. While every financial scenario differs, couples should at least initiate the prenuptial agreement conversation with each other. That way, honest lines of communication have been opened over, say, an unlikely surprise piece of mail outlining a prenup from your partner's family lawyer.

We recommend hosting the conversation in a private space where you both feel comfortable opening up about finances. Again, money talks are encouraged among couples, but they aren't all too common. Flexing this relationship muscle takes time and it all begins by picking up the set of weights.

Prenup vs Postnup: What's the Difference?

Can you get a prenup after marriage? Now that you're well-versed in the world of prenuptial agreements, there may be some regrets among those who are already married. Not to worry though: the postnup is here. Similar to prenups, the postnuptial agreement allows spouses to enter contracts around their respective financial situations to protect themselves in the event of a divorce. The prenup is signed during the engagement while the postnup is completed after marriage contracts are signed.

We Want a Prenup. What Now?

You've decided one (or multiple) of the aforementioned circumstances applies to you. Between wedding planning and other commitments, you may be limited in time or financial resources as has traditionally been the case when couples turn to a marriage lawyer. Since Millennials and Gen Z are a financially-savvy generation, with many preferring to complete everyday tasks from the comfort of their homes, HelloPrenup is a resource for couples who want to protect their wealth–with ease. At $599 per couple, the digital prenup service is co-founded by a marriage lawyer and can be customized.

The process begins with a questionnaire filled out by each respective party. From there, the couple works through their proposed prenuptial agreement digitally and legally. The process prompts a dialogue that otherwise may not have been broached by future spouses–working through everything from debt to estate planning.

If you're both entering marriage with tricky inheritance expectations, child custody agreements, or other bespoke needs, it's best to turn to a marriage lawyer in your state so both you and your partner can take time to work through an iron-clad prenup–that works with both signatures.