The Knot Financial Survey 2022: For the Love of Money

Whether you're in a new relationship or have been married for years, making shared financial decisions can be challenging. This study takes an in-depth look at all aspects of how couples today are managing their finances. The Knot surveyed 1,000 U.S. adults in a relationship, and the most notable finding was that females in a heterosexual relationship report notably lower self-confidence and knowledge in financial topics compared to males.

In this report:

- Perceptions around financial confidence

- How does financial knowledge come into play?

- Communication is key

- Setting the financial stage and establishing expectations

- How do couples feel about separate bank accounts?

- Planning for the future

- Survey methodology

Perceptions around financial confidence

There are many factors, which can impact someone's overall outlook when it comes to finances, including relationship and job stability, overall stress level and more. Fortunately, data shows at least 84% of couples feel 'very or somewhat confident' in both themselves and their partner to "maintain long-term happiness in a relationship" and "find a career/job that will make me happy". Given current global events/economy, it's not surprising that there was a bit lower agreement about keeping stress levels low (75% "very or somewhat confident").

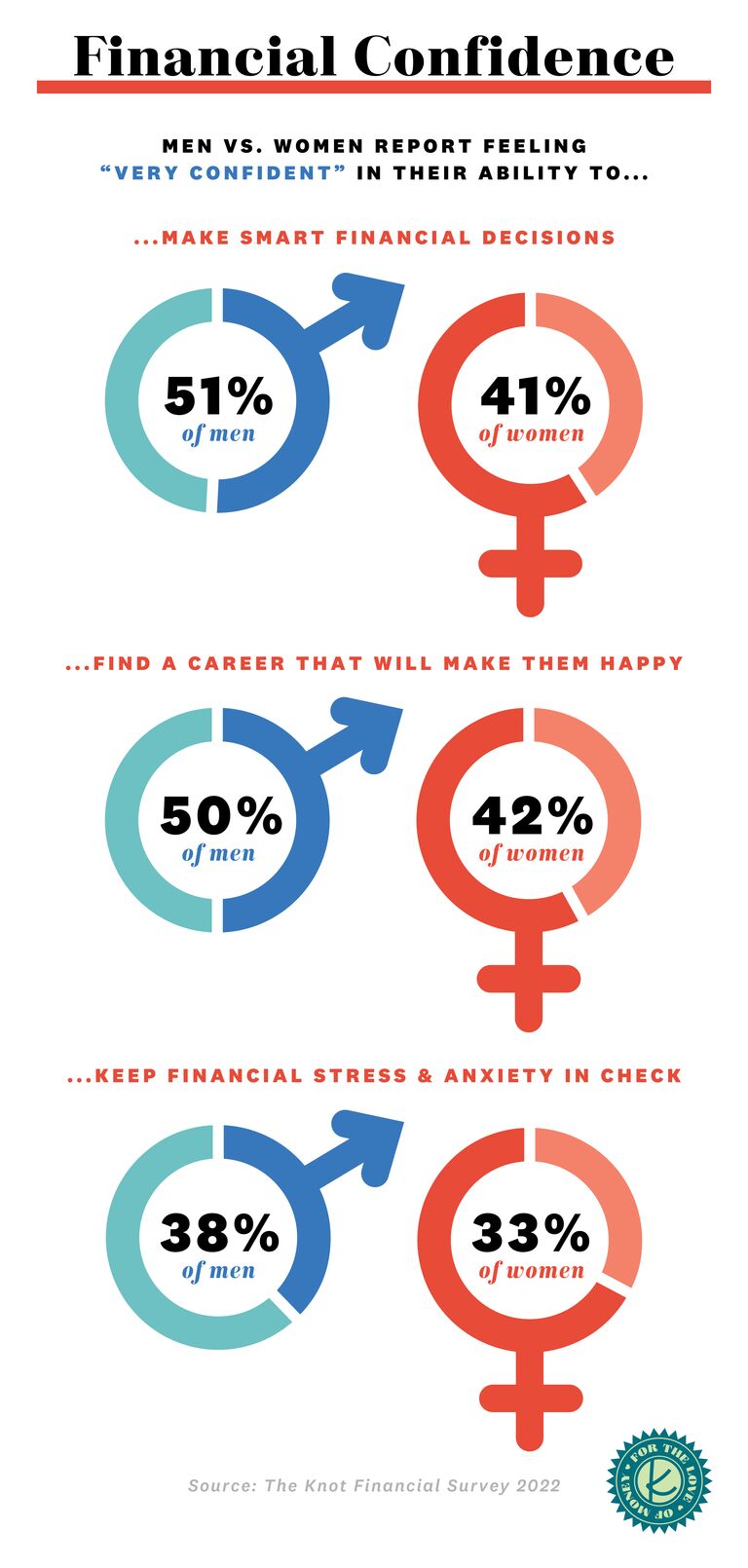

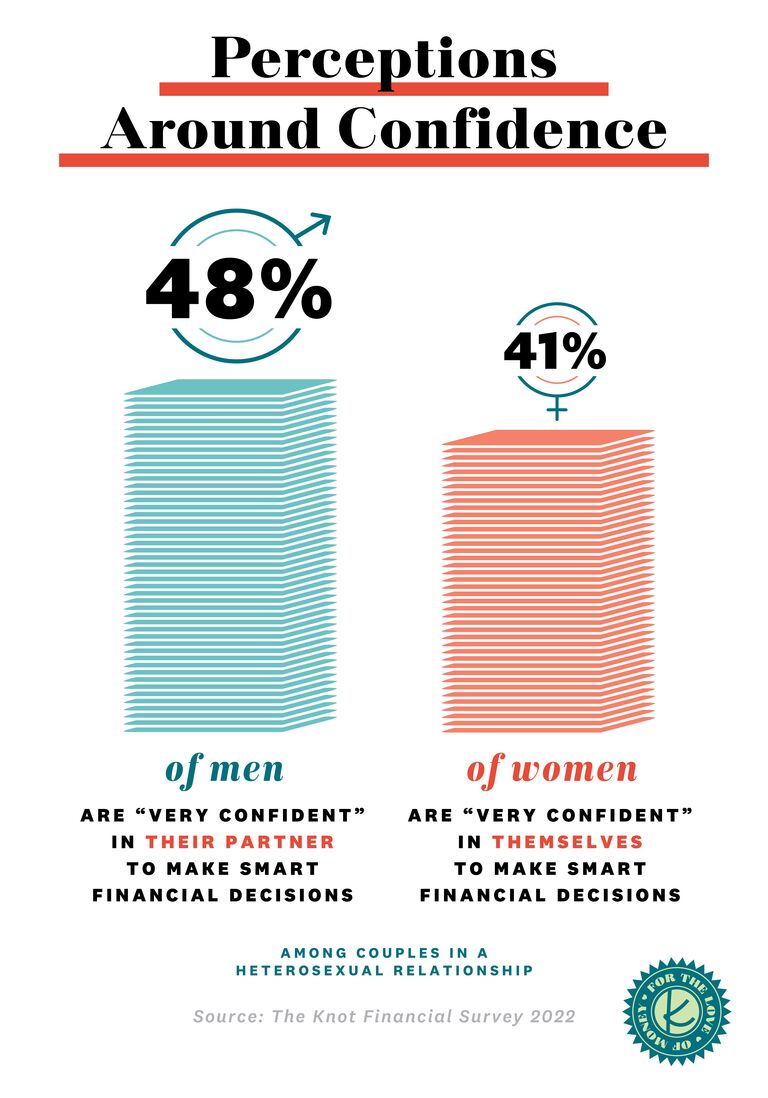

When looking at where consumers show especially strong confidence (saying they are 'very confident'), notable differences emerge between males and females in heterosexual relationships for certain statements. Males reported higher confidence levels in themselves to "make smart financial decisions" (51% vs. 41%) and "find a career that will make me happy" than females did (50% vs. 42%). Not only do men report feeling very confident in their ability to make smart financial decisions more often than women do, but they are 7% more likely to feel very confident in their partner than women are in themselves. So, what's the key takeaway? Perceptions around financial confidence still see a gap when looking at gender. There are many reasons for this confidence difference including that for a long time women had more limited career opportunities and even today continue to be underrepresented in certain industries and senior roles.

How does financial knowledge come into play?

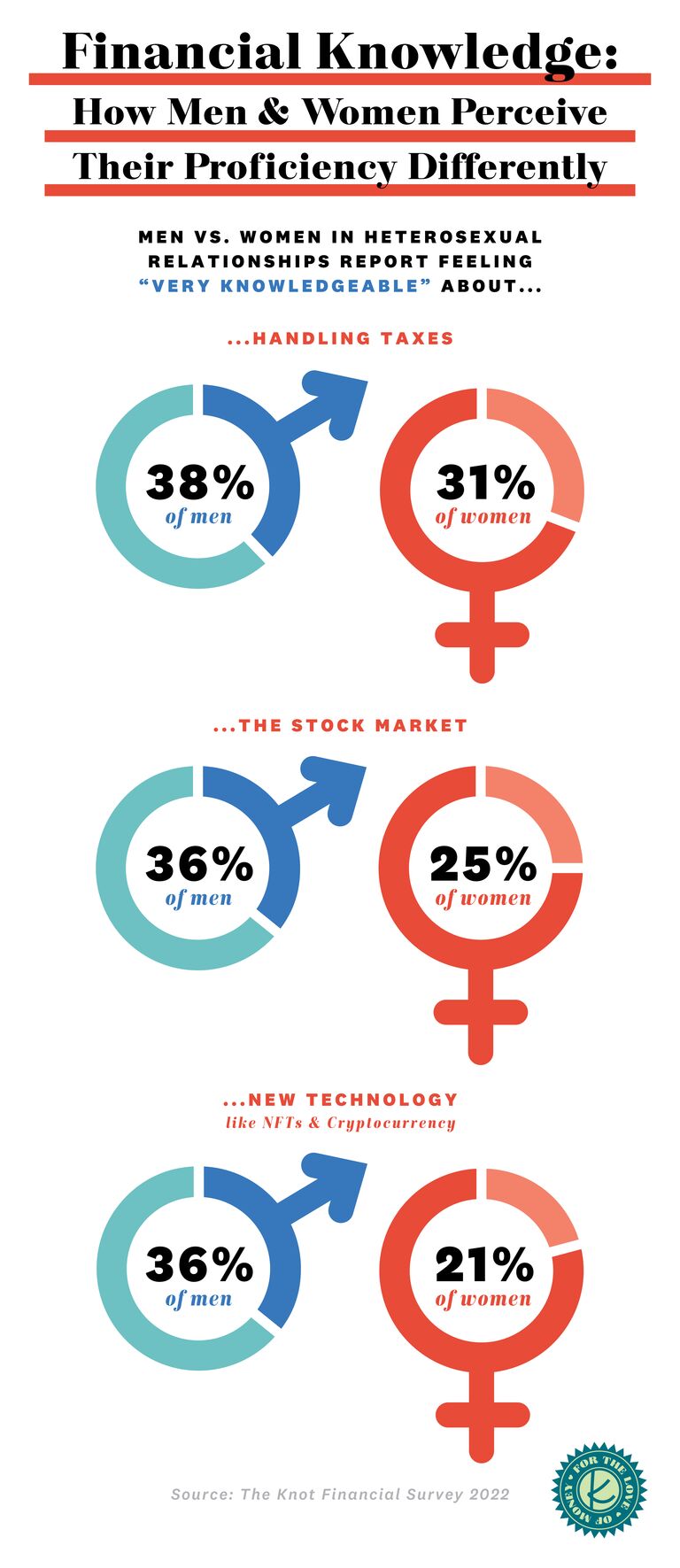

The vast majority of couples (89%) report feeling very or somewhat knowledgeable in managing day-to-day expenses, and 84% report they are somewhat or very knowledgeable in best practices for saving money. Though, similar to how men in heterosexual relationships report feeling more confident than women do about financial topics, they are also more likely to feel knowledgeable about certain topics. Specifically, men are more likely than women to report feeling very knowledgeable about handling taxes (+7%), the stock market (+11%), and new technology such as cryptocurrency (+15%). One reason for this difference may be that women continue to shoulder more of the responsibility for maintaining household chores and responsibilities, so they might have less time to focus on their financial knowledge or learning new topics compared to their male counterparts.

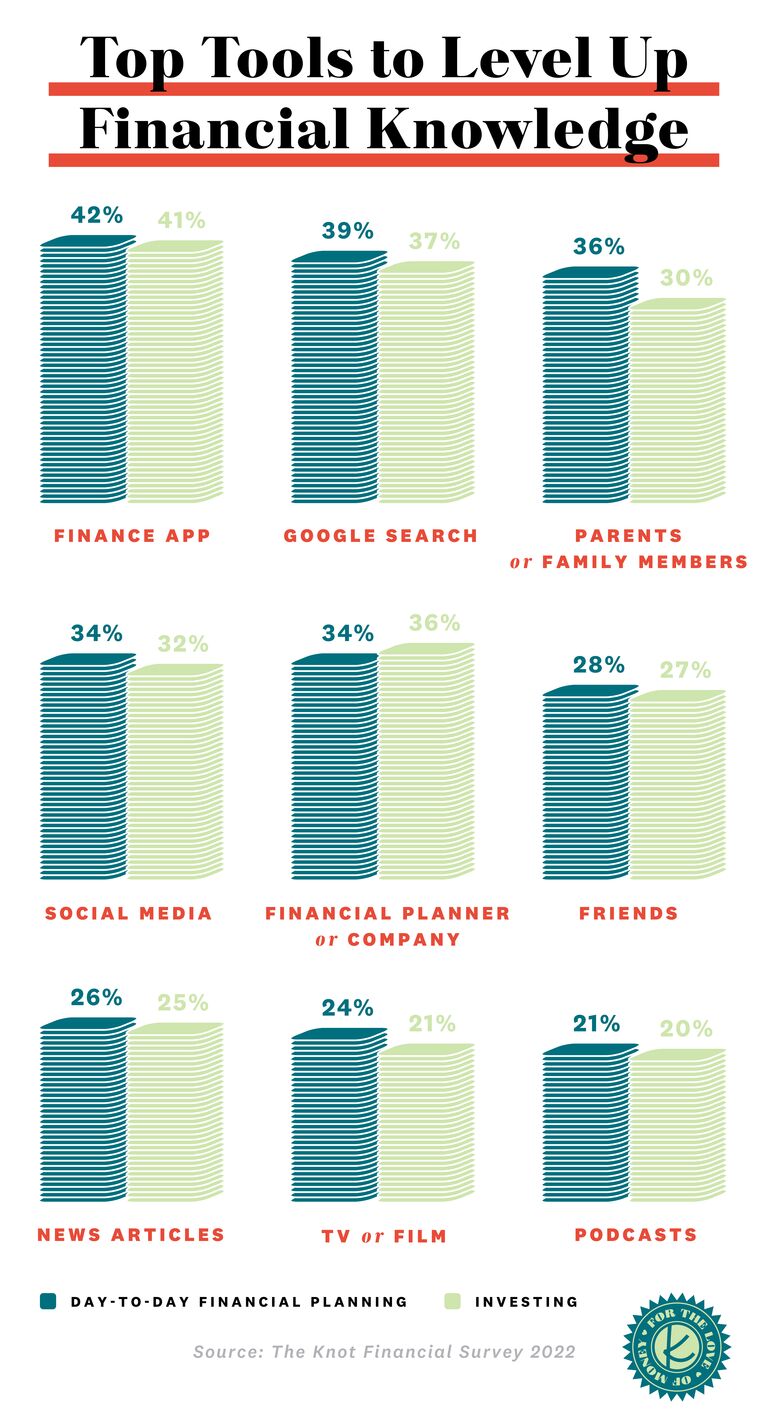

Fortunately, there are a variety of available tools and resources to level-up financial proficiency – finance apps are most popular with roughly 4 in 10 adults utilizing them for day-to-day financial planning and/or for staying informed about investing. Among those in heterosexual relationships, these apps are used more often by males than females (48% vs. 39%) and data also shows significantly higher usage among males for relying on financial planners and TV/documentaries to level up financial knowledge. For females who do want to grow and learn, experts note that there are an increasing number of websites and social media accounts geared specifically towards women that may offer a more relatable perspective.

Communication is key

When it comes to discussing money and finances, the frequency varies depending on several factors such as the stage of one's relationship (i.e., married vs. dating) or length of the relationship. On the whole, data shows about 7 in 10 are discussing the topic of finances at least on a weekly basis with 32% discussing it a few times a week. When you look at couples who are dating or engaged vs. those who are married, the first group is more likely to have these discussions at least on a weekly basis. With the number of life changes and details to figure out when you're dating or engaged, it's no surprise that finances are often top of mind among that cohort.

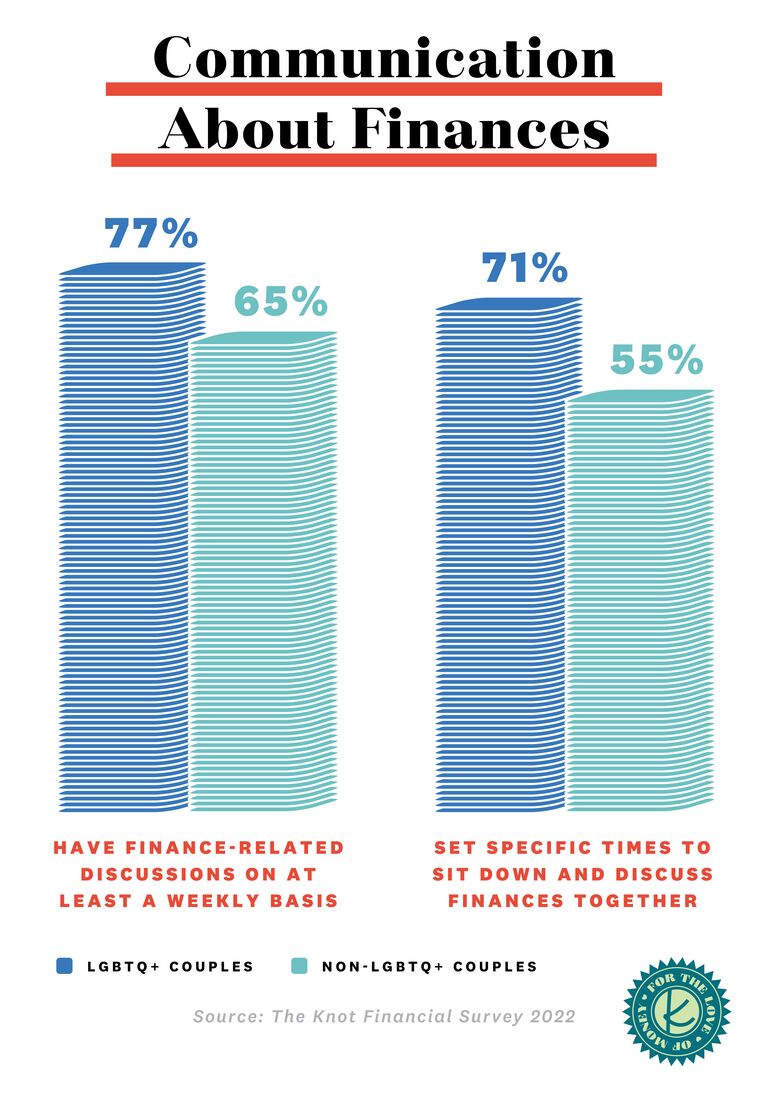

Research also shows that LGBTQ+ couples are talking about finances on a more frequent basis than non-LGBTQ+ couples; 77% of LGBTQ+ couples discuss it at least weekly compared to 65% of non-LGBTQ+ couples. LGBTQ+ couples are also more likely to have a set time to discuss finances (71% vs. 55%). At the end of the day, each couple needs to determine what works best for them, whether that looks similar or different to someone else.

When it comes to talking about money, 76% couples find it very or somewhat easy to discuss money and finances with their partner. 10% indicate that it is somewhat or very difficult; words and phrases used to describe reasons behind the difficulty include "awkwardness", "different values", and "poor communication." So, though its not always a cake walk, having the finance-related conversations as often as needed is crucial to maintain a healthy relationship.

Setting the financial stage and establishing expectations

A step most serious relationships must take is determining how the finances between two partners will be arranged. According to our data, 50% of respondents strongly agree that they have an equal say in financial decisions with their partner, while the other 50% indicate that one person has a larger voice than the other, at least to some extent. Among those who, on any level, say that financial decisions aren't made with equal say, 45% believe it leads to an imbalance in other areas of the relationship and 29% say it causes friction. However, 37% believe it has no effect and 9% say it has a positive effect on the relationship, showcasing the fact that what works for some might not work for others. But, with the majority having negative sentiment about the lack of equal say in financial decisions, it's important that each partner is listening to the concerns of the other and ensuring that both voices are heard and considered.

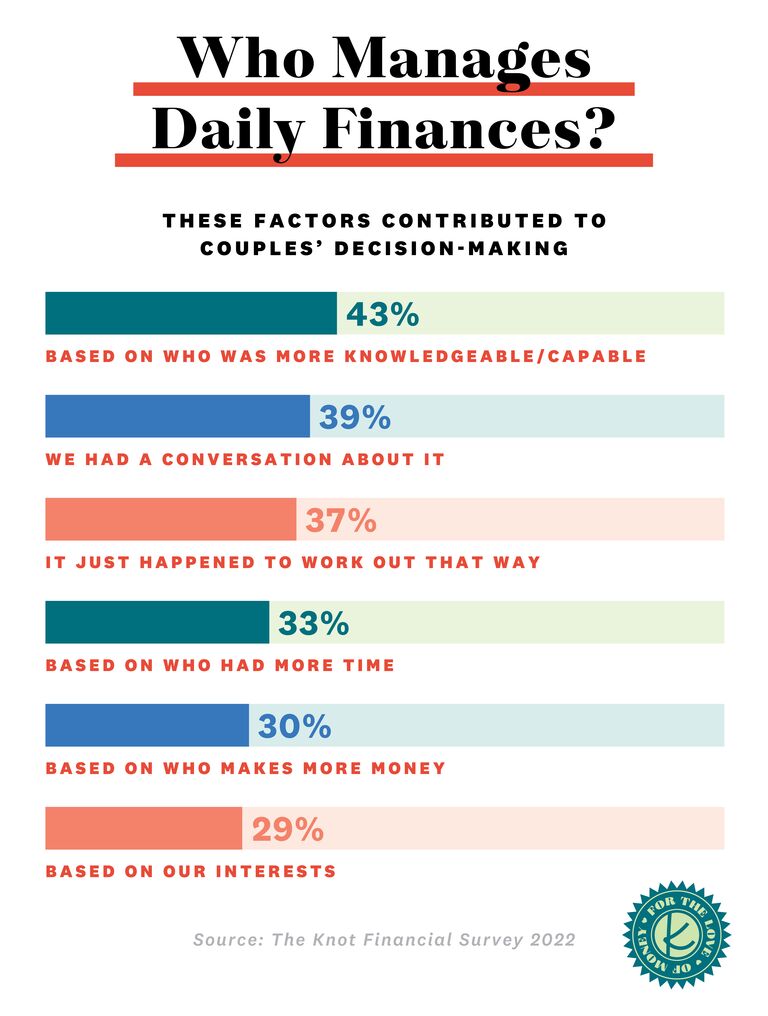

When it comes to running the day-to-day finances, one-third of couples report that they share management responsibilities with their partner, leaving the other 67% who has one partner managing most or all of the finances. Respondents were most likely to say that the most financially knowledgeable/capable of the two is the one managing the finances (43%) followed by the couple having a conversation about it (39%). Interestingly, more than a third said it just happened to work out that way (37%), while others said the decision was based on who had more time (33%) or made more money (30%). However, this decision is not set in stone for many – 78% said that this responsibility has shifted at least slightly over time, often due to a change in financial knowledge/experience or a shift in availability.

LGBTQ+ couples are less likely than non-LGBTQ+ couples to have one person completely managing everyday expenses (18% vs. 28%), and they are also less likely to strongly agree that they and their partner have an equal say when it comes to overall financial decision-making. Since same-sex marriage wasn't even an option in the U.S. until recently, there are fewer norms or role models for LGBTQ+ couples to use as a guide.

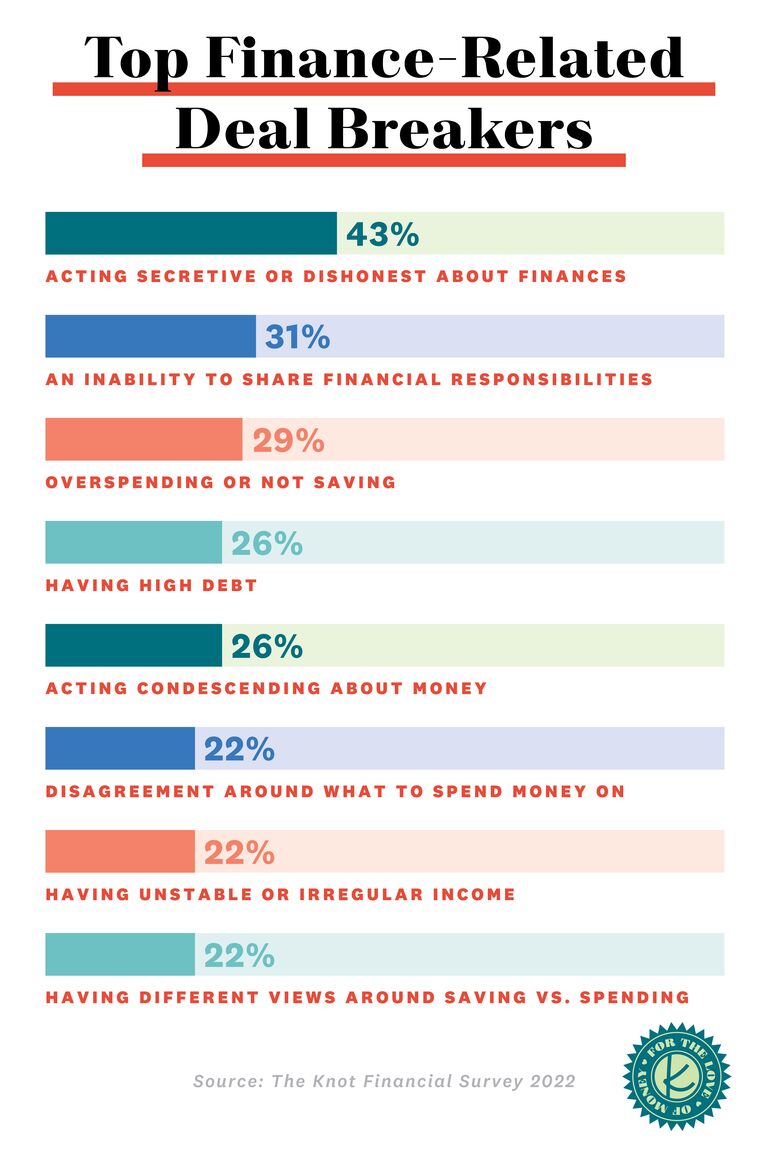

Though strong communication can help couples work through disagreements, couples acknowledge that there are certain issues that they won't compromise on. Respondents were most likely to consider it a deal-breaker if their partner was secretive about finances or dishonest about money being spent (43%). Other top relationship deal breakers include the inability to share financial responsibilities (31%), overspending/not saving (29%), high debt (26%), and being condescending about money (26%). So, a friendly reminder: honesty, respect, and communication will always work in favor of a relationship, especially when it comes to money.

How do couples feel about separate bank accounts?

Though the majority of married respondents have at least one shared bank account with their partner, 63% also keep a separate account where only they have access to the funds; within heterosexual relationships, married men are more likely than females to report having a separate account (70% vs. 61%). There is a small percentage of married couples (14%) who keep a separate bank account that their partner doesn't know about with reasons for this ranging from wanting full control to giving them peace of mind. Ultimately, whatever couples are doing to manage their finances works for the majority as 67% are at least somewhat satisfied with the way their daily finances are managed.

Planning for the future

When planning for the future, a consideration for some couples prior to getting married is whether to have a prenup agreement. Data shows that respondents generally associate prenups with being "smart" (46%) and "sensible" (45%). On the other hand, they are also described as being "for wealthy people'' among 34%, and this is even more common for females (38%) than males (29%). Negative terms tend to fall to the bottom of the list though are present nonetheless, as 20% describe prenups as "cynical" and 17% describe them as "pointless". However, research shows that LGBTQ+ couples have more negative associations with prenups, describing them as pessimistic (+10%), pointless (+8%), and cynical (+8%) more often than non-LGBTQ+ couples. This may be a reflection of the fact that only in the past decade has marriage even been a right for LGBTQ+ couples in the U.S. Though sentiments around the notion look different for many, prenups are, in their most basic form, a means of preparation for an unfavorable outcome.

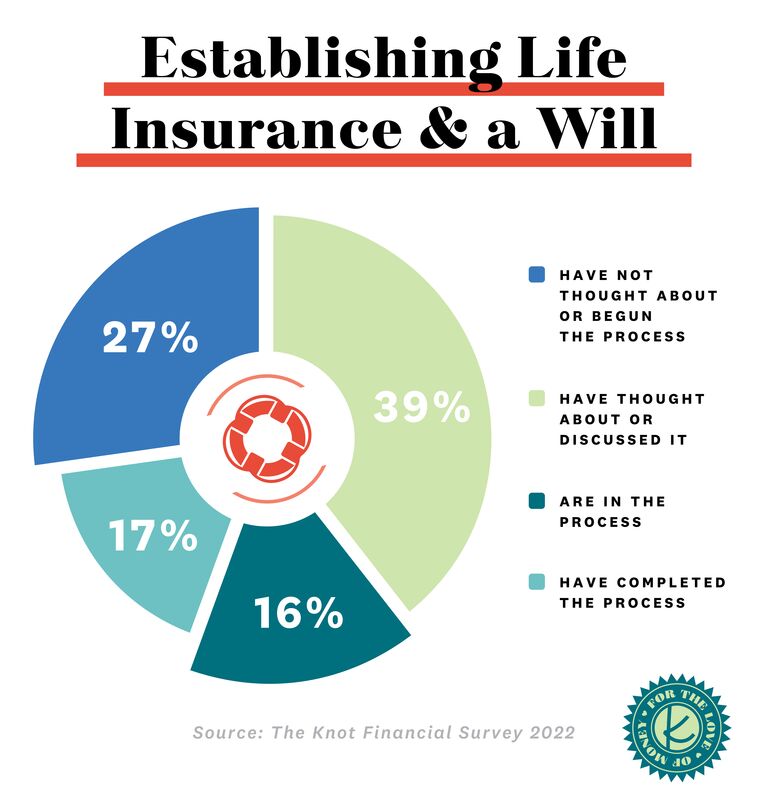

Switching to life insurance and living wills, only 17% of couples say they've already taken care of this (slightly higher among those married at 23%). While 16% are in the process of arranging this, the strong majority of adults (66%) haven't started taking any active steps towards life insurance or living wills. Regardless of where you are in life, it's never too early to establish smart financial management strategies. Ultimately, it will take some of the stress away, help set your relationship up for success, and leave you confident knowing that you are preparing for your future.

Survey Methodology

The Knot 2022 Finance Survey captured responses from 1,000 U.S. adults in May of 2022 who are in a serious relationship, engaged, or married; respondents were recruited via a third party platform. Survey respondents represent a variety of ethnic, education and income levels, and are geographically dispersed. The Knot Worldwide conducts research with more than 300,000 US brides, grooms, guests and wedding professionals.

Please note: The Knot and the materials and information it contains are not intended to, and do not constitute, financial or tax advice and should not be used as such. You should always consult with your financial and tax advisors about your specific circumstances.