How Gender Stereotypes Influence Financial Confidence Between Partners

The average divorce rate in the US hovers at 50% among couples, prompting questions about what specifically causes the demise of a relationship and its often-known precursor: the breakdown in communication. One point of contention often listed by spouses is money. According to The Knot Financial Survey 2022: For the Love of Money–which surveyed more than 1,000 respondents in the US, including heterosexual and LGBTQ+ couples in a serious relationship, engaged or married–financial dishonesty or furtiveness, in fact, was deemed a top deal-breaker (43% of all couples consider this a flag), just after infidelity.

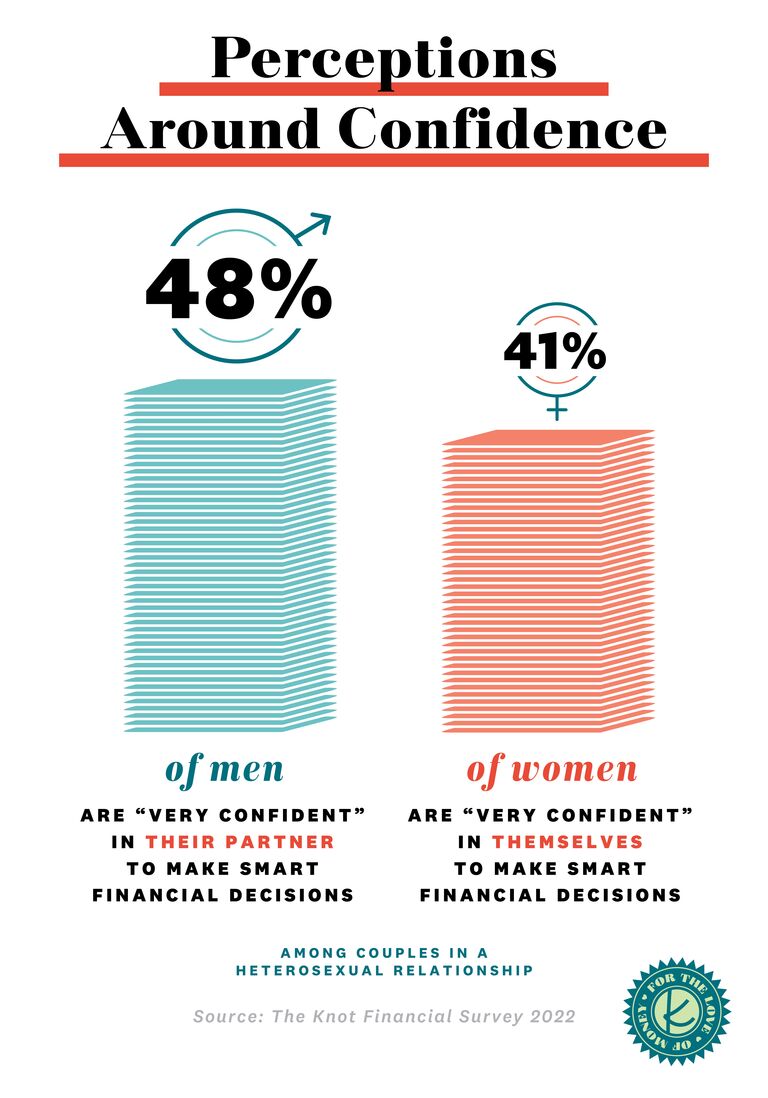

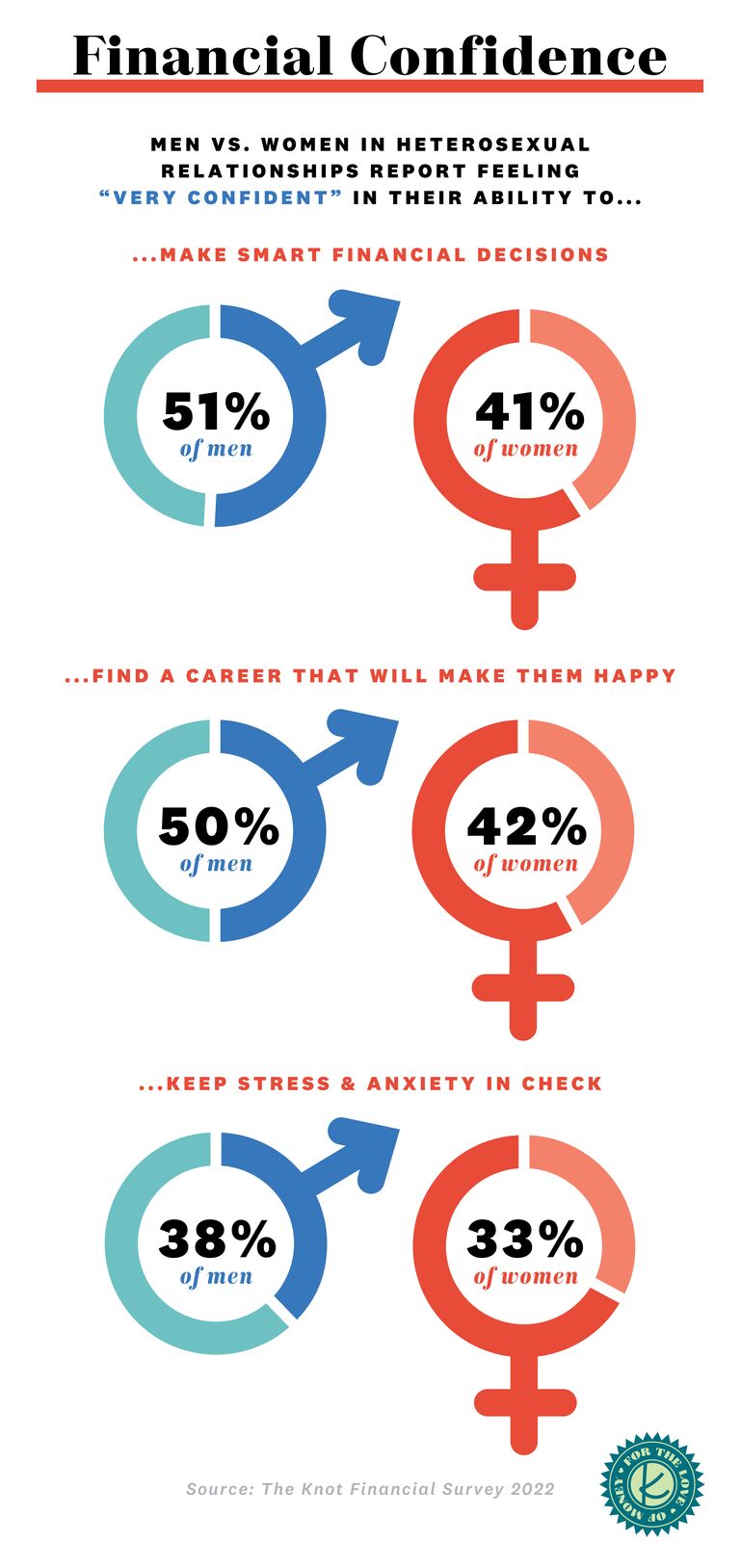

Tensions between partners often build with a lack of clarity, transparency and communication, making it essential for engaged couples to start talking about money management before entering a marriage. Such a practice paves a healthy foundation for to-be-weds as they evaluate their psyche around finances. Interestingly enough, our survey found that 48% of men in heterosexual relationships were "very confident" in their partner's ability to make smart financial decisions, as opposed to just 41% of women feeling "very confident" in themselves.

The dichotomy is notably rooted in perception. Such perceptions directly correlate to US history, notes sociologist, demographer and researcher, Arielle Kuperberg, Ph.D. "Historically, men worked outside the home more than women did, and since they were earning the money at the time, they usually were in charge of the family finances," she elaborates. "In fact, until recently, this was part of US law. Until 1974, if a woman wanted a credit card, she was required to have her husband co-sign her application, and banks were allowed to, and they did, deny credit cards to unmarried women. In the early 1800s, many states did not [even] allow women to own property legally."

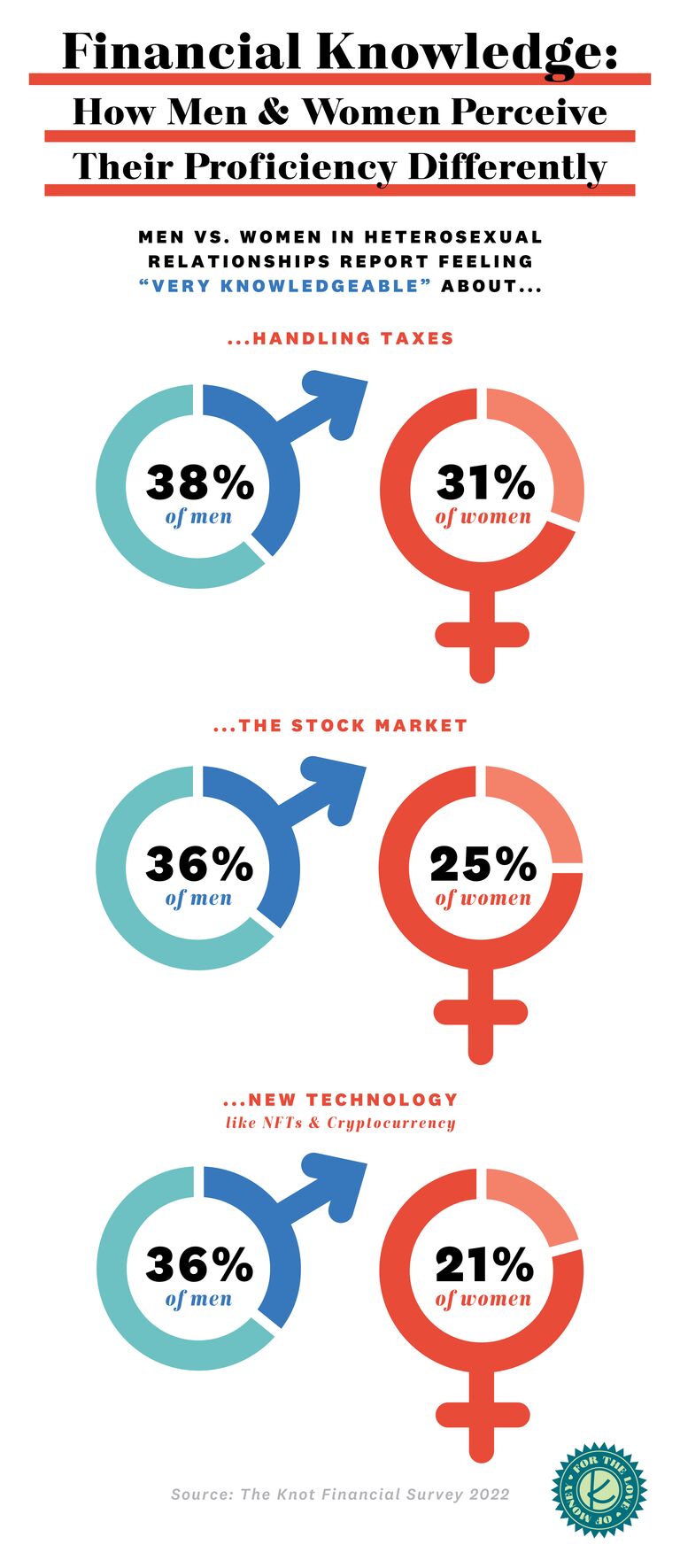

What's more: this narrative continues in 2022. Male respondents in heterosexual relationships were more likely to feel very knowledgeable than females in areas like handling their taxes (+7%), the stock market (+11%), and new technology, like cryptocurrency (+15%).

We break down the history and generational learnings that continue to influence finances in relationships. Furthermore, change is required, so that higher percentages of women feel equipped with financial knowledge and confidence. That way, they're able to take ownership of their household expenses, investments and financial pictures–attune to their partner. After all, what if both parties were to actively participate in the financial management of their marriage and household? Would this alleviate some of the stressors involved in reported relationship dealbreakers; and, in turn, lower the national divorce rate?

In This Article:

- How Do Financial Dynamics Influence Marriages and Families?

- How Financial Knowledge & Confidence Data Is Evolving

- How to Build Financial Knowledge & Confidence

How Do Financial Dynamics Influence Marriages and Families?

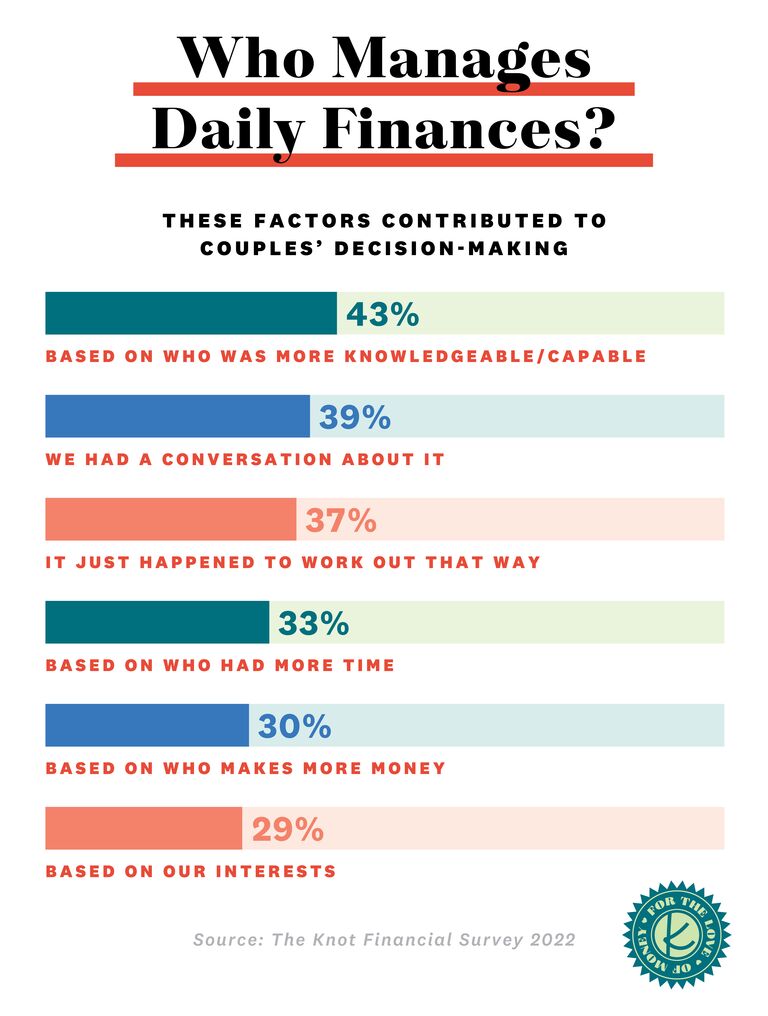

Financial well-being not only impacts couples but broadly, entire households. According to our survey, couples were most likely to have figured out who was responsible for managing the day-to-day finances based on who was more knowledgeable, according to 43% of respondents. That was followed by another 39% of those surveyed saying the decision was made after the couple had a conversation about the topic.

With men reporting that they feel more knowledgeable about finances than how women felt about themselves in this topic, the data indicates that men in heterosexual relationships are often taking the lead on household financial management. What's more, is that this is rooted in generations of learned behavior as gender roles are often tethered to the workforce.

"Historically, women have been in the paid workforce for a much shorter period of history than men. They have fewer women role models and mentors among their parents or grandparents' generation, who might help them establish confidence about their ability to succeed in their careers," says Dr. Kuperberg. "In terms of men being bullish on growth, women also may feel that if they are more bullish on career, it might come at the expense of having a family. After all, women have more biological age limits on when they can have children, which tends to coincide with peak career-growth years. This is factored in with how men have a longer biological period, in which they can have a family after they've established a career."

"The reality is that women's journeys often look quite different than men," affirms Kathleen Entwistle, Managing Director at Morgan Stanley. "Rather than a journey, it's more of a balancing act that requires women to juggle a number of priorities–which commonly compete with each other. Women are often tasked with the emotional labor of running a household, including budgeting, but do not participate in the bigger picture about the overall wealth discussions. They rather yield to others on this mostly because of outdated cultural norms suggesting women may feel less comfortable when it comes to investing and incorrectly imply that women are not good at it. Throw in motherhood, caregiving, retirement, longevity and the pay gap… women continue to take on more and more day-to-day responsibilities while losing confidence or time needed to consider investing and proper planning for big picture goals."

The Knot survey found men were 10% more likely than women to say unequal financial decisions lead to an imbalance in other areas of their relationship. "It can lead to men being in control of finances more than women in the household," elaborates Dr. Kuperberg. "This is not necessarily a bad thing, but it gives women less financial power in a relationship, which can turn out badly in the case of divorce, especially if men use their greater financial prowess and experience to manipulate the situation."

However, there's hope. Having money conversations early with children (regardless of gender) and broaching the topic of finances sooner in relationships are just two ways the dialogue can provide increased opportunities to women. Notes Entwistle, "I grew up in a household with a dad who had three daughters. He taught us the importance of money management and encouraged us to do whatever we set our minds to. He also advised me to study finance in college, because if you could understand finance, you could understand numbers and how to be profitable. My grandmother would bring me to the bank with her to literally clip her bearer bonds (the way people received tax-free interest decades ago). My manager at my first job explain to me why I would want to contribute to the company 401(k): the value of compound interest and a company match."

How Financial Knowledge & Confidence Data Is Evolving

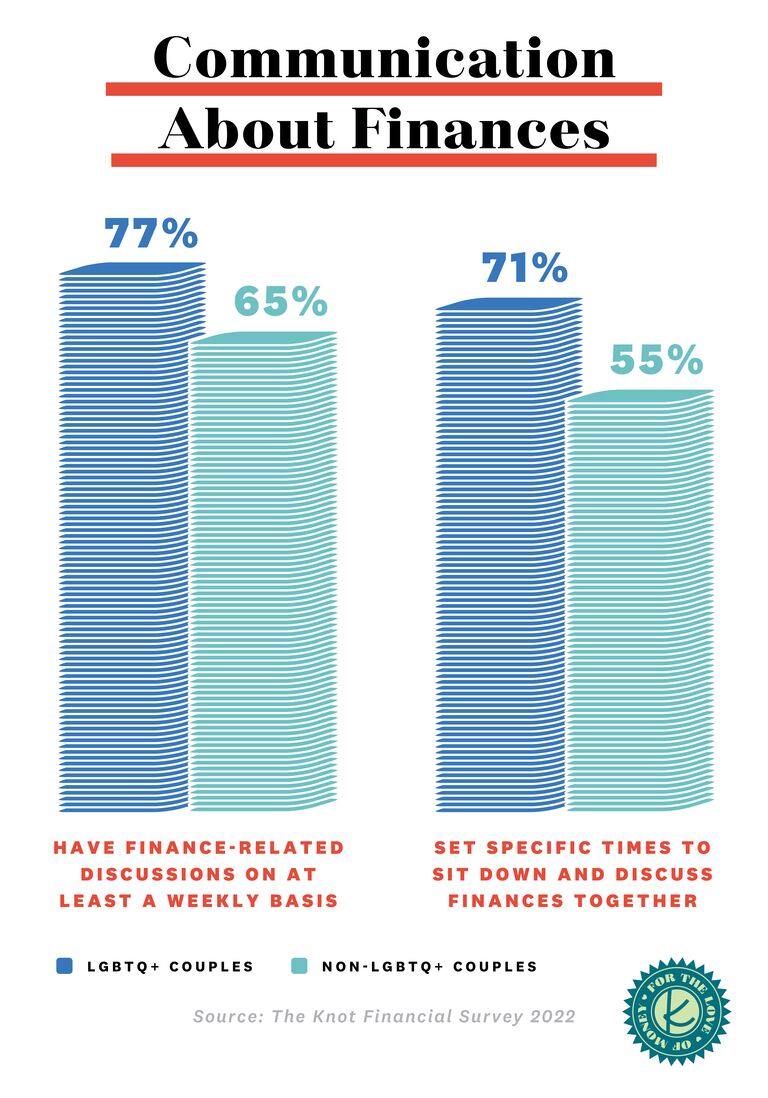

When day-to-day household expenses are involved, LGBTQ+ couples are less likely to have one person completely manage daily expenses. This means both partners were more inclined to actively participate in financial matters of the household. Our data also found that LGBTQ+ couples have more finance-related discussions (77%) and set aside time to unpack their finances (71%) over heterosexual respondents. However, this survey reflects a limited number of years of marriage, given that the landmark Supreme Court ruling, Obergefell vs. Hobbs, was made in 2015.

Whereas nearly three out of every four LGBTQ+ couples sets aside time to discuss finances, only 55% of heterosexual couples do the same. Multiple factors likely influence these numbers, including the number of traditional tasks, chores, and childcare many women are still largely responsible for within their respective households. This may result in having less time to focus on building financial knowledge and confidence.

These numbers are, however, slowly evolving to become more equitable, according to a January 2020 Gallup poll. While the numbers reveal that women are still handling traditional tasks, leaving them with less time to focus on other opportunities like investing, the distribution of work between partners is growing. "Times have changed and the vast majority of women now work. Plus, states all allow women to own property and their own credit cards," adds Dr. Kuperberg. "However, because of financial history, men are often the ones in charge of finances in the households. Men may talk to their sons more about finances than they talk to their daughters, and that makes their sons more comfortable with finances than their daughters."

In fact, Gallup found that 31% of men are still making savings and investment decisions for the family in 2020, though these tasks are being distributed equally between partners. As we look forward, additional societal changes–like the evolving workforce, increased technology usage, moderate adjustments in household tasks, and the rising average age of marriage–are just a few factors that could bring about further change.

Technology (think: online banking, credit card apps, budget-tracking tools and personal finance brands), for example, is making money management more accessible to all parties. In some instances, these tools are prompting conversations between couples. "The dynamic is changing. Most young adults today are using apps, automating savings and investments," affirms Entwistle. "One couple I know has a monthly conversation on what they spend by tracking whether they went over their budget. If so, they ask why and how they can fix that? This couple talks about their investments and they know what they own."

According to The Knot 2021 Real Weddings Study, the average age of marriage is 34 years old. This number has increased with each passing decade; and within relationships, more time means more flexibility to pursue individual careers and interests. What's more is there's hope on the horizon as these dynamics are ever-shifting. While men were more likely to say they were the breadwinner in their relationship (among heterosexual couples), they also said the dynamic has shifted over time (44% vs. 35%). In short, the same person who was originally the breadwinner replied they were no longer playing that role.

Finally, couples are talking now more than ever about money and their respective careers. With that, confidence builds not only within themselves but trust between partners compounds. "By asking questions around goals, family planning, stay-at-home parenting and such, you're building an ongoing conversation," says Entwistle. "You can ask questions like, 'Is fitness a worthy expenditure for you?' The couple I mentioned previously, Kevin and Betta, are focusing more on lifestyle 'wants' than the boring topic of budgeting. In fact, they have joint financial accounts: they bank, accrue points, and split up tasks together for full transparency. This couple is having constructive conversations, building a healthy relationship with their money, and they both have a good understanding that building wealth will help them reach their goals."

How to Build Financial Knowledge & Confidence

Building self-confidence and assurance in relationships requires intention and practice, says therapist Alyssa Mancao, LCSW. "Speaking of the inner narrative; what is it that you are telling yourself about making financial or career decisions? Some examples might be: 'It's too overwhelming' or 'I don't have the skills?'" she notes. "Pay attention to the critical or negative thought that arises, and simply replace them with something a bit more neutral such as, 'I can learn something new.' Another example is, 'Yes it's hard, and it's achievable.'"

Reflect on Your Financial Feelings

Entwistle echoes the sentiment. "Interestingly, it starts with a conversation by understanding how money has played a role in your life," she begins. "We all use money, pretty much every day, but it can mean something different to everyone. It may help you buy necessities, such as food and a home. It may offer the freedom to purchase luxuries or experiences, like traveling or going to a concert. Or, it may provide the ability to access important resources such as education and healthcare. Money can often feel like an off-limits topic but it shouldn't be."

Observe Societal Conditioning and Let It Go

Our subconscious minds absorb and retain information, without us even realizing how much of our biases are formed by others' opinions. Gender stereotypes play into financial management in households. "Part of this will shift generationally," says Dr. Kuperberg. "My daughters' generation–they are 3 and 9–will almost all grow up in households in which their mothers are working, and in a growing number of households women are out-earning men. Of course, we also must do away with the notion that women are 'naturally' worse at math. They are not."

Curate Technology to Build Knowledge

Screen time can be a friend or a foe, but it's up to you to determine your algorithm and the accounts you choose to engage with most. "With the internet at our fingertips, there are several finance and career accounts that are women-led, women-run, and women-owned. I suggest following these accounts to influence your algorithm into content that inspires and motivates you," says Mancao. "The evidence shows that representation matters and can be helpful with building feelings of self-efficacy and confidence; so when you follow people who look like you and are doing the things that you wish to be doing, this can help with building your own inner narrative that feels supportive, motivating, and encouraging."

Self-Educate

Those who want to grow and learn in this arena can access articles, books and all types of content from money and wealth gurus to grow their financial knowledge. "Generally, financial information about Roth IRAs, how to save for retirement, how to apply for a mortgage, and how to build a credit history, to name a few, should all be taught at the high school level to everyone," notes Dr. Kuperberg.

However, for those who didn't receive the schooling, seeking out additional resources at bookstores or podcasts will benefit you in the long run. "Create small and reasonable goals for yourself that point you in the direction of learning something new each day," adds Mancao. "Whether it's listening to a new finance or career podcast episode, reading an article, or reading a chapter of a finance book. Remind yourself that the information is out there and you are capable of digesting it."

Talk About Money… Often!

Over a glass of wine, an eight-course Omakase, golf or the department store. Whatever the context, women, too, should discuss finances. "Talking about money with friends, significant others, family members or colleagues is a great way to learn more about how you can make smarter choices for your future," says Entwistle. "Normalizing the conversation about money and removing acceptable, but inaccurate norms and stereotyping, will allow for healthier discussions. It also allows for better opportunities to build confidence and creates space for equal participation in the money conversation. By normalizing these conversations and having regularly scheduled time for discussions and review of your priorities when it comes to your goals and values, you will have a deeper understanding of money and will be inspired to have honest conversations about the meaning of money in your life so you can explore new horizons. This will lead to confidence and stronger participation which will in turn change the way money and finance are handled in the future. Progress!"

Pass It Onto Your Loved Ones

The data is changing—a promising sign for the differences between genders and all couples moving forward. "Having adults share their insights with me was very instrumental in my career path and eventual success in the financial industry," Entwistle concludes. "It is true that currently there are more men than women in this industry but that is changing. As more women are realizing their true potential and embracing financial literacy, education, knowledge and experience I believe we will see these numbers change over time."

Practice Makes Perfect… Or Something Like It

It may feel foreign at first as you flex new muscles, but building and stretching your financial knowledge will serve you, your partner and your loved ones in the long run. Don't be afraid to connect, seek new information, and expand your boundaries. "If you know someone that is already [investing or paying off debt], ask them if they have the space to share some of that knowledge with you," says Mancao. "If an expert offers a class, don't be afraid to sign up for it. When we can break the information down into small, sizeable chunks, the giant mountain of information won't feel so overwhelming."

"Don't wait until you know everything. Start today and form a habit. It takes time to build wealth, but if you set up the time to do this, you will be rewarded for your efforts," concludes Entwistle. "One of the greatest tools we have when it comes to money is knowledge. By educating yourself through conversations, research and practice–Did you learn to play the piano on the first try?--you will be better positioned to make smarter financial decisions today, while you build a solid foundation for your future and prepare for important life milestones ahead.

Then, watch it compound.

Please note: The Knot and the materials and information it contains are not intended to, and do not constitute, financial or tax advice and should not be used as such. You should always consult with your financial and tax advisors about your specific circumstances.