The 3 Money Conversations To Have Before Saying "I Do"

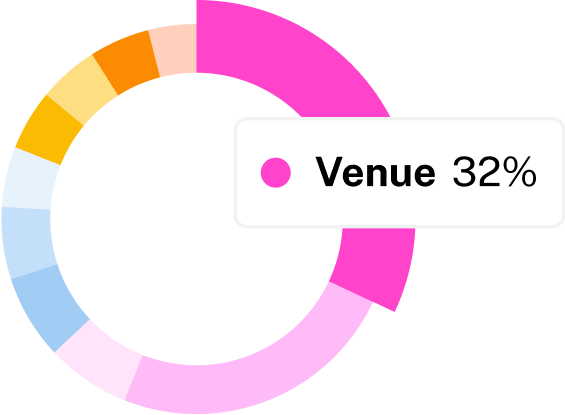

Before exchanging vows, there is typically a lengthy checklist to mark off with your soon-to-be partner. Finding a venue, discussing which holidays will be celebrated where, and of course — those money conversations you'll need to have before marriage. After all, one-third of married couples attribute finances to be their primary source of conflict.

Instinctually most couples who are seriously dating or engaged talk about money but tend to keep things too surface-level or too futuristic. And because finances can reach such a broad spectrum of smaller topics such as travel, future family planning, and even community donations, it's easy to let a few critical money conversations slip through the cracks before The Big Day.

By having these money conversations well before marriage, you'll be less likely to be blindsided by your spouse's preferences and decisions down the line, helping to strengthen your lifelong commitment to each other.

Money Conversation #1: Grocery Budget

Budgeting food is one of the greatest money-savers, so sharing a common expectation of "what's on the menu" can help you with decision-making as well as help save you all thousands of dollars as a couple.

This money conversation to have before marriage may seem like a piece of cake (no pun intended), but creating and executing a grocery list with your partner can cause more tension than expected. For example, one of you may be into a more organic-focused and healthy diet, often trying out fad diets and new recipes. Whereas the other partner was raised on frozen TV dinners and loves to pick-up fast food a couple of times per week. You want to unwind after a long Monday with red wine and a paleo dish from your favorite Instablogger. They want to down a soda and enjoy their favorite frozen Lean Cusine. A couple could begin to purchase double the food on weekly grocery runs, resulting in higher bills and deep-rooted resentment.

Deborah Price, founder of the Money Coaching Institute and author of "The Heart of Money," explains, "[Fights about grocery budgets] are often about underlying issues, like security, or health, or deep emotional fears."

Money questions to ask before marriage:

- How do you currently meal plan for the upcoming week?

- What is your current grocery budget, and what would you expect our family grocery budget to be?

- Do you prefer to grocery shop or get your meals delivered?

The answers to these questions will give both parties an idea of the other partner's reference point, lifestyle, and meal planning experience.

Money Conversation #2: Debt Repayment Plan

With seven out of 10 people entering marriage with debt, it's obvious why this is an important conversation to have before exchanging vows. When it comes to debt repayment plans, it's essential to discuss existing debt, interest rates, timelines, and the sacrifices made to be debt-free, should that be a goal at all.

One mistake newlyweds make is having a "big picture" plan with little to no execution-focused details. A partner can enter a marriage, assuming the debt they have from college will now be paid-off by both partners. Similarly, one partner could be OK with a 20-year debt-repayment plan, but their spouse would like to follow the advice of a financial expert and pay off all debt within a couple of years, by any means necessary. (Yep, there goes your annual international trip.)

Money questions to ask before marriage:

- How much debt do you currently have, and how are the bills currently being financed?

- What are your expectations with debt-repayment; do you expect me to help you pay off your bills in any kind of way?

- What are the first things or luxuries we should sacrifice when reserving funds? (e.g., eating out, travel plans, clothing, cable packages, etc.)

Money Talk #3: Date Night

If you talk to any married couple, nearly all of them will advise you to "keep the romance" in the relationship. This can be with shared hobbies, adventures around the globe, or sweeping, romantic gestures reminiscent of the early days in dating.

No matter your partner's love language and the idea of a "perfect date," cash and planning will be involved. If one spouse is always looking to pinch pennies with a weekly Netflix and chill nightcap, their partner could begin to feel cheated or apathetic toward marriage aspects. To get ahead of this, sit down with your partner and discuss what date night and quality time together will look like after getting married.

Money questions to ask before marriage:

- What kind of dates do you envision us having when married?

- What is your love language?

- How much money would you like to spend on a weekly date night?

Though every marriage will have its seasons of discovery and adjusting, couples can build a stronger foundation, especially around financial literacy and intimacy, with having money conversations before marriage early and often.