A Joint Account for Wedding Expenses is an Easy Budgeting Hack

Figuring out who pays for what during wedding planning could be considered the best test of compatibility, but you can also make it easier on yourself by opening a joint account for wedding expenses. You don't have to be ready to completely join all finances or open a general shared bank account, but establishing one place for all wedding expenses on day one takes some of the loaded guesswork of deciding who pays for what.

This can be a wedding checking account, a wedding savings account or both, and it can help determine the financial planning timeline for engaged couples. You can even open credit cards for wedding expenses if you want to maximize points on your biggest expenditures, and those can be paid from the joint account.

But where do you start when looking into how to open a joint banking account or create a financial plan for wedding expenses? Two financial experts shared their expertise in navigating these questions with couples. And, if you're looking for vendors to fit your budget, search by price range on The Knot Vendor Marketplace, then use the free wedding budget calculator to make sure you're staying on track throughout the process.

In this article:

- What's the Definition of a Joint Bank Account?

- Should I Open a Separate Bank Account for My Wedding?

- What to Look for in a Joint Checking Account

- How to Open a Joint Bank Account

- How to Best Use a Joint Account for Your Wedding

What's the Definition of a Joint Bank Account?

A joint bank account, also referred to as a joint checking account or joint savings account, is a bank account that is controlled by two parties. This means both people have full access to both deposit and withdraw funds into and out of the account.

Often, married couples or couples who live together will use a joint bank account for everyday expenses like rent or a mortgage, utilities and groceries. Some will merge all their accounts into a joint bank account and others will keep everything separate.

"It's a great idea for couples to have individual accounts with funds that allow each of them to make independent spending decisions, but wedding costs shouldn't fall under this 'individual expenses' category," says Kaylin Dillon, certified financial planner and owner of Kaylin Dillon Financial Planning. Then there are those who open a joint bank account for a specific purpose, whether that's a savings goal, like a house, a vacation or, of course, a wedding.

Should I Open a Separate Bank Account for My Wedding?

Opening a shared bank account for your wedding makes it easier to track the money coming in and out, understand where you are in terms of budget and monitor that you're each putting money in according to the split you've agreed to. Shinobu Hindert, certified financial planner and creator of Empowered Planning explains that opening this bank account is a great way to start making joint financial decisions as a couple. "Having a joint bank account gives each person transparency into how money is being spent and opens up a dialogue about money. Having conversations about budget expectations and how each partner makes spending decisions is necessary as well," Hindert says.

What to Look for in a Joint Checking Account

Hindert recommends looking for accounts that have little to no fees, no account minimums and access to both cash and an ATM card. These should be as easy to use as possible, and you shouldn't be penalized for low account minimums because you may plan on spending all of the money in the account as it comes in. "Typically online bank accounts will have the least amount of fees and are mobile user-friendly. A traditional bank may have more restrictions and since this account has a short-term purpose you want to maximize the flexibility features," Hindert says. You'll also want to make sure that the account is easily accessible for both parties for deposits, withdrawals and monitoring.

How to Open a Joint Bank Account

Before you open a joint account for wedding expenses, discuss your overall budget and how you plan on using the funds. Then, open the account together with a clear vision of how it will be used. These are a few of the considerations to make.

1. Find an Account That Works for You

Depending on what you're looking for in terms of mobile banking access, account minimums and availability of ATMs, there may be one bank that works better for you than another. Find the one that works best for you as a couple.

2. Open the Account With All Required Information

When you go to open your joint account, make sure you have everything you need the first time, whether you're doing it online or in person. This may include a driver's license or other ID, as well as your social security card and basic personal information.

3. Agree on How You'll Each Deposit Funds

Dillon points out that you're forming a financial partnership in addition to a romantic one, and that can help inform how you'll deposit funds into the account. "When couples aren't sure about how to split the costs, I suggest splitting at a ratio proportional to their income. This will help emphasize the importance of making all wedding decisions truly joint decisions."

4. Discuss How You'll Handle Overages

If you go beyond the funds deposited into the account, how will you handle those? "You could agree up front that any overages beyond the agreed budget will also be split according to the same ratio as the initial funds," Dillon says.

5. Give Both Parties Access and Have a Plan

In some couples, one person wants to be the money person and the other prefers to take a back seat. That's fine, but make sure you're both on the same page so you don't end up with resentment if one person is doing the majority of the work. Give both parties access to the bank account, and have a conversation about how you'll split the budgeting, paying vendors and monitoring the account.

How to Best Use a Joint Account for Your Wedding

The joint account can be used for any expenses or deposits that come up through the wedding planning process and through the honeymoon.

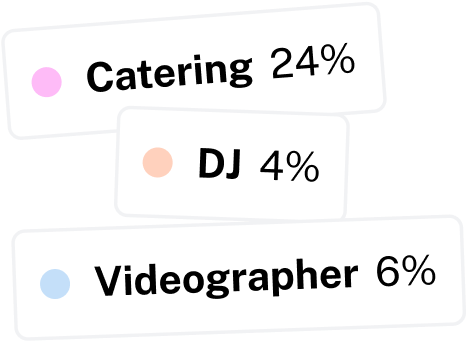

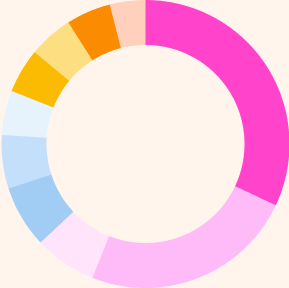

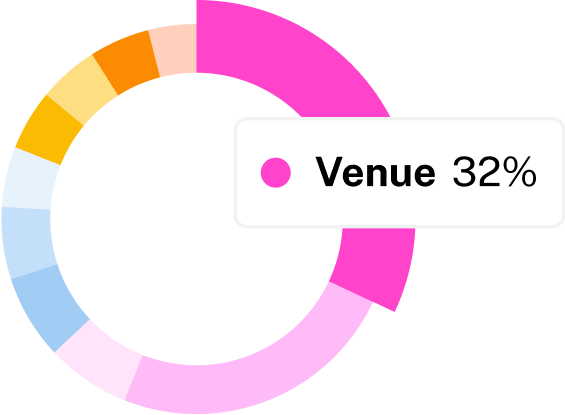

Pay Vendors

"The accounts should be used to pay for venue costs, catering, flowers and whatever expenses have been agreed on by the couple," Hindert says. Also, when to pay vendors may vary as they may request a down payment or a payment in full. Paying them through the joint account will help you stay on top of where you stand on the budget.

Track Your Wedding Budget

Hindert suggests, "Use an app to track the expenses and anticipated expenses." Many online banking accounts will have an app that makes it easy to see when money comes in and where your money is going.

Link to a Cash Wedding Registry

You can use your joint wedding account as the recipient when you add cash funds to your registry. Many couples offer an easy way for friends and family to give cash as a gift (this is often more popular in certain regions!) and a cash funds wedding registry can go straight to your joint bank account.

Pay for Your Honeymoon

After the wedding is over, the account can be repurposed into a place to save money for your honeymoon. Cash wedding gifts can go directly to paying for your dream trip to Italy and Aruba and, yet again, you'll have an easy place to save, manage and track your money.