Are Wedding Payment Plans a Thing? A Vendor Weighs In

Picture this: There's a vendor that you've had your heart set on since you saw their work online before you were even engaged. But their quote is higher than you were anticipating. Enter: Wedding payment plans. While you'll need to prioritize your wedding budget and possibly cut back in places, if you're eager to make a certain wedding vendor work, consider paying in installments so the cost is more manageable for your financial situation.

What's the Deal With Payment Plans? Read On: Do Payment Plans Exist? | Vendor Options | Talking to Vendors About Financing | Finding Vendors With Financing | Estimating Payments

Can You Pay for Your Wedding in Installments?

ICYMI: Wedding payment plans are a thing. What's more, this option for how to pay for a wedding is becoming more common among a wide variety of vendors, thanks in large part to an increase in online bill-pay systems that make buy now, pay later (BNPL) easier to handle for businesses. According to wedding planning expert Holly Gray, owner of Anything But Gray Events in Los Angeles, "you are always able to ask a vendor if they are willing to provide a payment plan over time! That is not an unusual request and actually something that most vendors will probably already have as their standard practice."

However, don't be surprised if a vendor doesn't offer payment plans. The most common system for paying vendors is to pay a deposit when you book them and then pay the remaining balance as one lump sum shortly before the wedding.

If a vendor that you want to book doesn't offer payment plans, consider looking into strategically paying for that vendor via a credit card for wedding expenses or a wedding loan. If you find a card or loan whose terms you're comfortable with, paying off your balance can act as a sort of make-shift payment plan in the absence of one from the vendor.

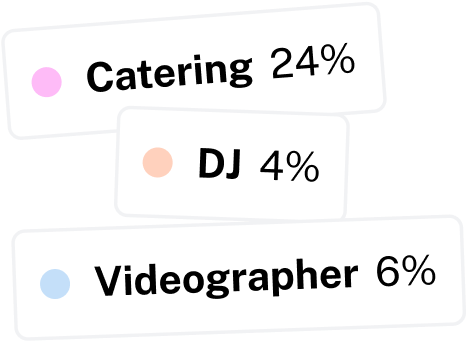

Wedding Vendor Payment Plans

How and when to pay vendors will vary depending on each pro's business model and practices. However, Gray explains that "most vendors will require the final payment to be made no later than 1 month to 2 weeks before the wedding date. Most wedding vendors prefer final payments before the event date versus on the wedding day unless previously started. Always go back to your vendor's contact to understand their payment structure, payment dates and methods."

Wedding Venue Payment Plans

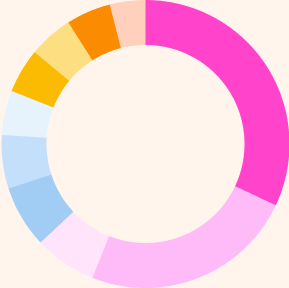

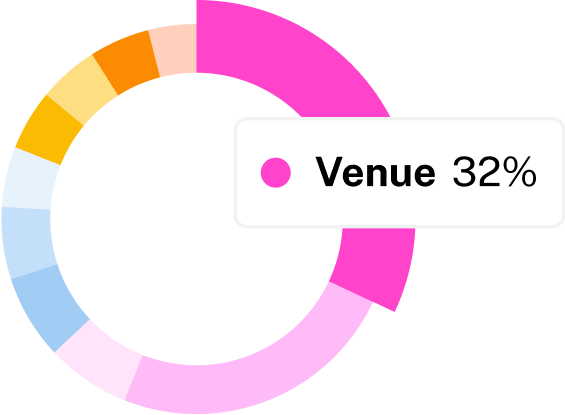

Do wedding venues offer payment plans? Often, yes—The most common vendor to have a payment schedule is the wedding venue. Especially if you're hosting a hotel wedding or a venue that includes catering, the total bill that you'll be paying the venue will be quite substantial. As such, wedding venues often offer payment plans that break the cost up into two to five installments (four payments is especially common) that are spread out and more manageable for couples.

Wedding Planner Payment Plans

Gray, a planner herself, emphasizes that although payments vary from vendor to vendor, it is common to have some kind of initial deposit as the first part of a vendor payment. For Gray, she requires 25% as a non-refundable retainer. This is the first of four installments that her clients pay for her overall fee.

Wedding Ring Payment Plans

Can you buy wedding bands with payment plans? Yes—If it's important to you to invest in high-quality wedding jewelry, you'll be glad to know that financing options are available to make the cost more manageable. Many major wedding ring and jewelry companies offer financing plans through online buy now, pay later companies like Affirm and Afterpay. For example, both Grown Brilliance and Brilliant Earth offer financing options through Affirm.

Wedding Photographer Payment Plans

As with all vendors, payment plans vary from business to business, but it's not uncommon for wedding photographers to allow for their cost to be split into multiple payments, such as three or four installments.

Wedding Dress Payment Plans

Did you know there are payment plans available for some wedding dresses? Many major wedding dress brands partner with third-partner financing companies to make the cost of a wedding dress more manageable. Notably, Pronovias and David's Bridal offer financing through Affirm. Meanwhile, KHYA Studios provides payment plans through onedayPAY. Additionally, it's worth asking the wedding dress salon you visit whether they have a financing policy you could consider.

Other Wedding Vendor Payment Plans

For wedding vendors with a smaller total fee, such as an officiant or a ceremony string quartet, a payment plan is less common. Typically, these vendors get their payment, minus a deposit, in one payment either right before or at the wedding.

Gray emphasizes that every business approaches payments differently, but despite the differences there are some common red flags to be aware of. Notably, she explains that deposits are standard practice and "If you are not asked for a retainer when signed with a vendor, that is a red flag as almost every legitimate wedding vendor will require some sort of retainer when booking them." Additionally, she also says that if a business only accepts cash payments this could also be an indication that their business is not legitimate.

How to Talk to Wedding Vendors About Payment Plans

Honesty is the best policy—This is true for a lot of things, but especially when it comes to talking to your wedding vendors about money and payment plans. "It should not be considered taboo to ask for a payment plan," says Gray. As with anything when it comes to talking to or negotiating with vendors, the manner in which you approach the conversation is key. "Do so respectfully and communicatively and make sure the payment plan is reflected in writing within your contract as to not miss a scheduled installment," advises Gray.

Once you've established a payment plan with a vendor, it's key that you honor the agreement and stick to the outlined schedule. "If for some reason, a vendor payment can not be made on the date it is due, it is the couple's responsibility to communicate early and clearly to the vendor," says Gray. "Weddings can be very expensive with several fees to multiple vendors due at similar times. If a situation is discussed early, clearly, and respectfully, there is a better chance the vendor will be able to work with you to extend the time needed to make the payment. Remember, small businesses are owned by people too! People who also need to pay their own bills. Communicating with vendors clearly, in writing, as opposed to ghosting or ignoring a payment because of embarrassment."

How to Find Vendors Who Offer Payment Plans

As you're researching vendors on The Knot Vendor Marketplace, take some time to read the detailed descriptions that each vendor writes. If a pro offers a payment plan, there's a good chance they'll mention it there. However, even if they don't list one, don't let that scare you away from reaching out to them. Send your potential vendor an email to inquire about financing.

Here is some sample wording that Gray suggests couples use when contacting their wedding vendors about this topic: "Hello, [name of pro]. We are very excited about your services and are ready to move forward with a contract. Do you offer payment plan options to accommodate our wedding payment budgeting?"

How to Estimate Your Wedding Payments

While payment plans may feel like a way to save money on a wedding, you still need to ultimately be able to pay for the services you're hiring. As you're laying out your wedding budget and using a wedding planning spreadsheet to organize a calendar for your payments, it's important to remember that the final balance for many of your vendors will be due before the wedding day.

"While it can seem counterintuitive to have to pay a balance of services before your wedding day (or surprising to your parents, if they are covering costs), this is standard in the wedding industry," says Gray. "For many vendors including wedding planners, the majority of the planning and services have been months in the making. Vendors, like florists or DJs, that have to purchase supplies or rent equipment to ensure they are available on the wedding day will expect all payments to be completed prior. Logistically, vendors do not wish to be chasing down payments on the wedding day or even after the wedding. By taking care of your vendors and following their payment schedules, allows the couple to relax and enjoy their wedding day without thinking they have to remember to bring final payments to vendors who are in the midst of their services on your wedding day."

Please note: The Knot and the materials and information it contains are not intended to, and do not constitute, financial or tax advice and should not be used as such. You should always consult with your financial and tax advisors about your specific circumstances. This information contained herein is not necessarily exhaustive, complete, accurate or up to date and we undertake no responsibility to update. In addition, we do not take responsibility for information contained in any external links, over which we have no control.