How to Actually Pay For Your Wedding

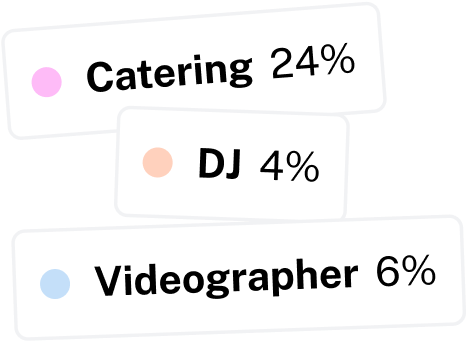

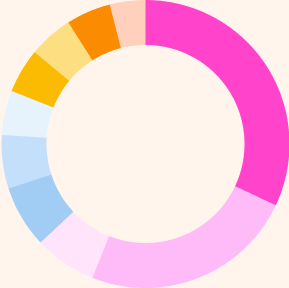

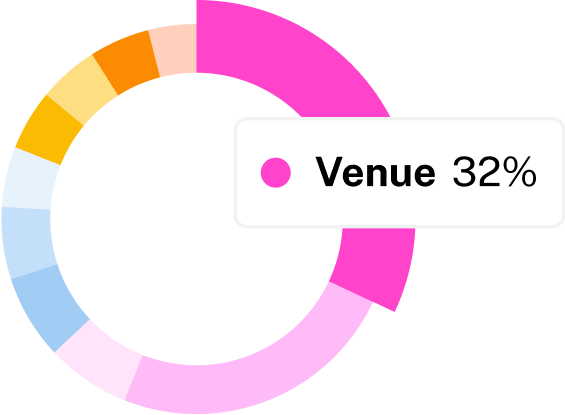

Your wedding is probably the priciest party you'll ever throw in your life. It's easy to say you'll stick to a budget, or have tons of fabulous DIY details, but at the end of the day, your venue and catering bill could amount to way more than you imagined—and figuring out how to pay for a wedding can even further complicate matters. While the average wedding cost in the U.S. is around $35,000, a realistic budget varies widely depending on a variety of factors, including your location, guest count and more. Pro tip: To know how much to spend based on these variables, use our free wedding budget tool to explore pricing in your area and see what real couples typically spend.

Once you've nailed down the total amount you can spend, it's important to understand your wedding budget breakdown and when payments will be made during your planning timeline. Saving for a wedding isn't an insurmountable task—we promise. Here's how to save up and pay for your wedding by spending smartly and cutting back a little along the way.

In this article:

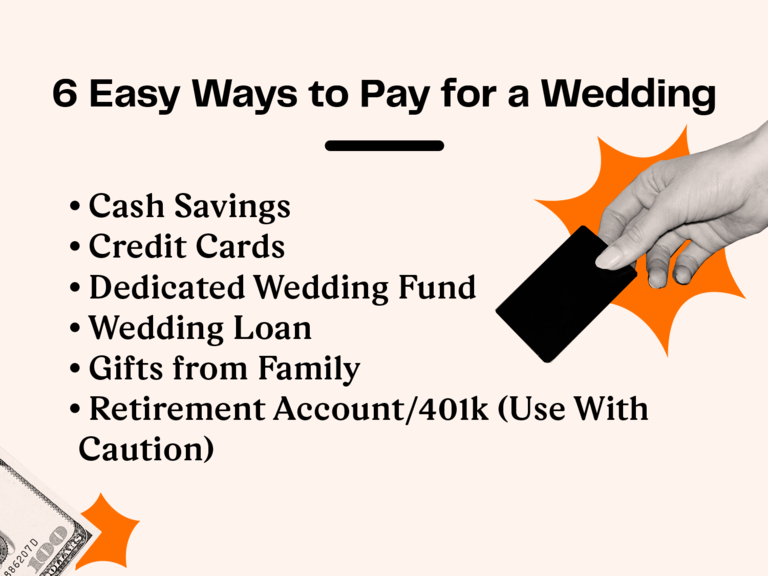

How to Pay For a Wedding: 6 Easy Ways

There's no right or wrong way to pay for a wedding—it's different for everyone, based on your individual financial situation. While some couples go the traditional route of having family members contribute to the wedding, others foot the bill themselves. These are the most common ways to pay for a wedding (note that many couples choose to use a mix of the below options):

Cash Savings

It's important to evaluate your current savings when creating your total wedding budget. Yes, you can save more during your engagement (more on that later), but knowing how much you can spend right now will give you a more accurate picture of what your wedding budget should be.

Credit Cards

There are benefits to using credit cards for certain wedding expenses—but there are risks involved. Paying on time and avoiding overspending will help you avoid penalties and debt down the road.

Dedicated Wedding Fund

Create a sinking fund as part of your monthly budget where you can set aside funds specifically for your wedding. We'll talk more about how much to add to your wedding fund a little later.

Wedding Loan

Yes, there are risks involved with taking out a loan for your wedding, but they are a convenient way to get additional money. Be sure to weigh the pros and cons before borrowing money.

Gifts from Family

Parents don't have to contribute to their child's wedding, but often do—just remember that if your parents provide funds, they get a say in decisions like the guest list, venue, etc. If you'd like your parents to contribute, have an honest and respectful conversation early in the planning process.

Retirement Account/401k (Use With Caution)

Can you take money out of your 401k for a wedding? Technically, yes. Should you? Probably not. You'll have to pay penalties and taxes, and it sets up a bad precedent for the future. Only use your 401k as an absolute last resort.

Can You Use a Cash Registry to Pay for the Wedding?

By setting up a cash registry with The Knot, your guests can contribute money to help you reach financial goals. However, you shouldn't rely on these funds to pay for your actual wedding for a variety of reasons, most practically because you likely won't receive these cash gifts until very close to or on your wedding day, and you'll have to pay for wedding-related products and services beforehand. However, you can use money from your cash registry to pay for your honeymoon, a down payment on a house and more.

Saving For a Wedding: 6 Useful Tips

If you're paying for the entire wedding or a large chunk of it yourself, you'll need to figure out how to set aside funds for the big day—in addition to paying for your regular monthly expenses. While there are ways to cut wedding costs, being smart about saving for a wedding can ensure you'll come out of your event with healthy finances. We asked David Bach, founder and chairman of FinishRich Media and author of Smart Couples Finish Rich to help share the secrets to saving for the wedding.

Use this simple math equation.

If you have a big budget goal that seems daunting, divide it into smaller chunks that are easier to digest. The simple math trick that makes it all work? Take the sum of your desired budget and divide it by the number of months you have to save up. Getting married in a year with a budget of $20,000? Divide $20,000 by 12 (which equals about $1,700 per month). If that amount seems like too much per month, add more time or try cutting back on a few of your big-ticket monthly expenses to help you save. "That's literally how simple planning [financially] for a wedding can be," says Bach about this relatively simple math.

Where should this money go? Into a newly created "wedding account," of course. Throughout your life, having a savings account dedicated to something more exciting than a retirement plan, like travel, a wedding or another big event, is a good idea and will help make saving more fun. Obviously, the amount of time you'll need to save up for a wedding depends on your current income and expenses. For example, if you can only save $800 a month, but your dream wedding looks like it will cost somewhere in the $50,000 range, you'll be saving for over five years. When you're thinking of your budget, work within realistic parameters and don't set unattainable goals. For some couples, more drastic sacrifices will be required, while other to-be-weds will be splitting the cost with relatives to help lighten the load. Think about what's best for you and your partner and what makes the most sense. Be practical about your limits. The amount of time it takes you to save will depend entirely on your own circumstances.

Cut back on monthly expenses.

Do you belong to a gym, club or subscription service that takes a monthly sum out of your account? Cutting back on these types of expenses can have some of the quickest effects on your account balance. Turning off your cable could save you $100 a month, and ending a gym membership could put an extra $75 in your account each month. You're not going to give up your cell phone, but you might be able to change the data plans or forgo on-demand movies for a year. You should make a habit of reaching out to your cell phone and cable companies annually and negotiating a better deal. Sometimes, just by asking, you can get a price cut on your bills. Even $20 off a monthly bill can save you $240 over the course of a year. Nowadays, it's so expensive for a company to acquire a new customer that most will lower their fees just to keep you around. And if your attempts at negotiation fail, consider cutting out nonessential monthly costs. We're not talking about your health plan or your life insurance—those things are non-negotiable. But for things like cable, Netflix, Amazon Prime, Birchbox and Spotify—anything that debits you on a monthly basis—the time has come to really consider if these are must-haves you truly need, or if you can sacrifice them for a bit in favor of a larger wedding budget—and that fancy cake you have your eye on.

Stop little spending habits that add up.

Scale down your shopping during the months you're saving or only buy lunch out one day a week. You'll begin to see a little wiggle room for your wedding account in no time. "I call this 'the latte factor'—the way we spend money on a lot of little things without thinking about it," Bach says. "It could be your coffee, bottled water, eating out for lunch and dinner, or having drinks. It could even be taking a cab instead of taking the subway, or parking your car closer to your office and therefore paying a higher parking fee." A dollar here, three dollars there—it adds up over days and weeks. Cutting back on a few (or a lot) of these expenditures can result in saving up to $10, maybe $20, per day—that's $300 to $600 per month. But don't worry—cutting out these expenses isn't going to change your whole life for the next year. Trust us, time flies when you're wedding planning.

Make bigger sacrifices, if you're willing.

Looking for any possible way to cut costs or find extra money to help pay for your wedding? There are some more drastic measures you can take as well. You could move in with your parents to save on rent for the year (or move in together if you haven't already). If you both own a car, consider selling one of them—that itself could save you more than $5,000 in expenses like gas, tune-ups and insurance. "The expenses from that car could pay for a third of the wedding," Bach says.

Use your credit cards—realistically.

If you're in the process of saving up for the wedding while you're making deposits to reserve your venue and other vendors, you're likely going to have to use credit cards. That shouldn't worry you as long as you're using them correctly (read: paying them off in full in a timely manner). Credit cards can actually protect you from fraud and make transactions easier, so we don't suggest avoiding them entirely as long as you've saved up enough, or will have saved up enough to pay them off before interest sets in. But one big thing to keep in mind: Don't start your marriage off in debt—it's never a good idea—and don't consider paying for things with money you don't have and won't have for a long time. You also shouldn't take out a loan to cover costs. "Going into marriage with debt for a one-day party is a huge mistake," Bach says. "People start their lives in these huge financial holes and it's just a shame. It's smart to create a specific wedding account to put money into and then simply reverse the math to come up with your savings plan." Bottom line: Don't spend more than you can afford.

Think of creative ways to make more cash and save.

Have you considered selling items you don't need anymore online? What about starting an Etsy shop or doing freelance work? This can be a great way to supplement your wedding fund. Once you have a plan in place to actually pay for your wedding, use our wedding spreadsheet to track expenses. It's also worth looking into expensive wedding dates to avoid and checking out some planning advice to get a handle on the whole process. Whatever kind of help you need, we've got you completely covered below. And let The Knot wedding planning app keep you on track every step of the way.

Kim Forrest contributed reporting to this article.